Obscure Stocks Annual Review

Updates on profiled companies

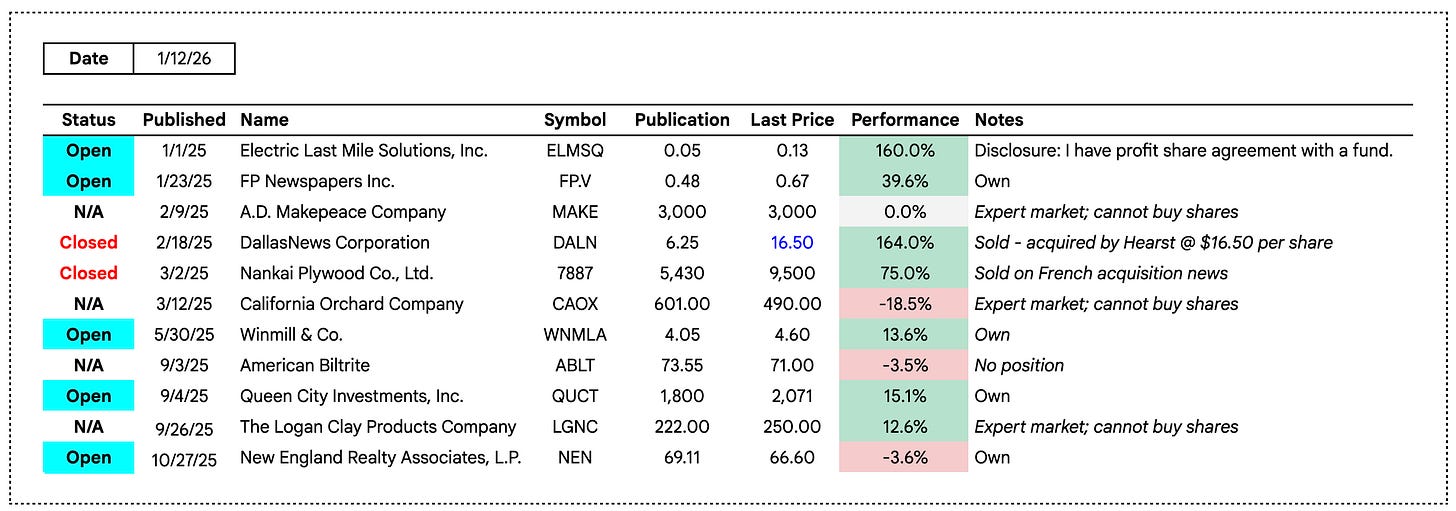

A few brief updates on some of the stocks profiled during 2025:

Electric Last Mile Solutions, Inc. +160%

Only a handful of new filings have been posted on the bankruptcy docket, the most recent pay applications have been legal invoices (shocker). As far as I know, there haven’t been any material updates on the Chancery shareholder litigation either.

As a reminder, ELMSQ trades on the OTC expert market. It is a risky, illiquid, and volatile security that hasn’t traded any meaningful volume since my original post. Take the quoted stock price with a grain of salt, and please read the disclaimer at the top of the ELMSQ post.

DallasNews Corporation +164%

DALN was acquired by Hearst for $16.50 per share in an all-cash buyout that closed in October. An affiliate of Alden Global Capital launched a competing bid for the business, but it proved unsuccessful. Like a complete fool, I sold my remaining position before the deal was announced. I lost confidence in management and saw signs of the business deteriorating much faster than expected. DALN began giving away digital Morning News subscriptions for free, and its subscriber count dwindled. I was insecure about my analysis, and I changed my mind at an unfortunate time.

Nankai’s stock has performed well since announcing the acquisition of a French company in October. As I highlighted in the post, Nankai’s track record in France has been less than stellar. I’ve since sold my small position.

California Orchard Company -18.5%

Mr. Market has punished alcohol-related businesses lately, and California Orchard has not been immune. Gen Z is drinking significantly less alcohol than elder generations, at least that is the current consensus. Maybe there will be some solid investment opportunities among the wreckage, but it’s a bloodbath out there.

Errors and Omissions

I had some free time to reflect on 2025, and I wanted to share a few self-imposed rules to improve my investment process and avoid stupid mistakes in the future:

Focus on profitable companies

I found myself owning several unprofitable companies in 2025, and I don’t intend to own perennial money-losers in the future. It’s almost always a bad bet.

Don’t become too attached to ideas.

I’m often wrong, and I want to find out when I am wrong as fast as possible. That means soliciting feedback from peers and taking it seriously, especially if the feedback contradicts my thesis. I think I have grown a little in this area, but there is still plenty of room for improvement.

Technical illiquidity can create special opportunities, but they’re not automatically special.

I ran into more than one burning building last year (e.g., Kohl’s, Crocs, Vera Bradley, Tile Shop, etc.) Oftentimes I cannot resist buying when I see violent, indiscriminate sell offs. I need to be more disciplined in these kinds of situations. I want to catch falling knives of companies I would want to own long-term, and most of the examples I mentioned do not fit the bill.

99 times out of 100 I don’t have an edge in merger arbitrage situations.

Some investors have this skillset, and I am not one of them. There are easier and better ways to make money.

I’ve been writing this blog for a little over a year, and I’ve thoroughly enjoyed getting to meet many of you during that time. Best of luck to all in 2026, and a sincere thank you for reading.

Love the self-reflection to improve your process. #2 in particular!

https://companycharts.substack.com/p/the-monthly-net-net-scan-75-tickers?r=6kpr46 May this list find you well.