California Orchard Company - OTC:CAOX

Most OTC-traded companies are relatively unknown; California Orchard Company is downright undercover.

Family-owned for over a century, it has no website, avoids the press, and keeps a tight lid on its dealings. Shares occasionally trade on the expert market, and annual reports are only distributed to shareholders of record.

Fortunately, a friend (and shareholder) was kind enough to share some recent financials with me, providing a rare glimpse inside of this stealthy company.

Why is it interesting? A large customer on the verge of bankruptcy recently transferred its obligations to another more creditworthy business. This change may set the stage for future sales of its long-held real estate, potentially creating significant value for shareholders.

History

Founded in 1919 by agricultural entrepreneurs Abram Hobson, John Lagomarsino, and C.C. Teague1, California Orchard Company began as part of a larger land package. The founders initially purchased about 8,000 acres of Monterey County farmland through Salinas Land Company.

California Orchard was spun out of Salinas Land Company with 1,905 acres. Its land originally produced a variety of fruits, vegetables, and nuts.

Since 2003, Salinas Land Company has held a controlling stake in California Orchard. Meanwhile, the descendants of the founders continue to hold seats on the company’s board.

The ‘Terroir’

Monterey County is known for its cool, dry climate and long growing season. The region receives only about a foot of rainfall each year. The fog and winds from Monterey Bay make it an ideal place to grow Chardonnay and Pinot Noir grapes.

In 1969, severe flooding from the Salinas River forced California Orchard and many others in the valley to rebuild their farmland. The disaster coincided with a tax incentive program, fueling an agricultural development boom.

Investors acquired thousands of acres of farmland to develop vineyards, reportedly receiving $3 in tax credits for every $1 invested.

Between 1971 and 1974 alone, 25,000 acres were planted, about half of Monterey County’s vineyard acreage today.

One of the most notable deals was Prudential’s acquisition and planting of the San Bernabe estate. At approximately 8,100 acres, it became the world's largest contiguous vineyard, which Prudential later sold in 1988.

Current Operations

Like many farms in the Salinas River Valley, California Orchard transitioned to grape-growing during the 1970s. And since 2000, all of its land has been exclusively dedicated to vineyards. Today, it grows its own grapes and leases land to grape farmers and winemakers.

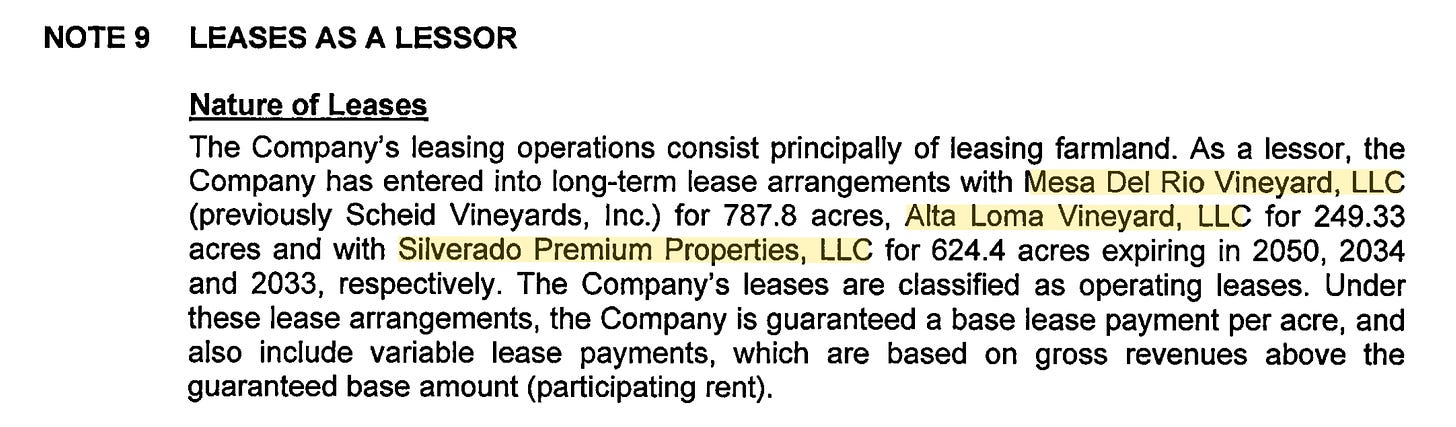

Vineyard Leasing

Vineyard leasing is a simple and profitable business. The leases are triple net—tenants cover rent, property taxes, crop insurance, maintenance, and utilities. The tenants also pay royalties on their annual production. These leases usually span 25 to 30 years, with extension options of 10 to 20 years, making them more akin to mortgages.

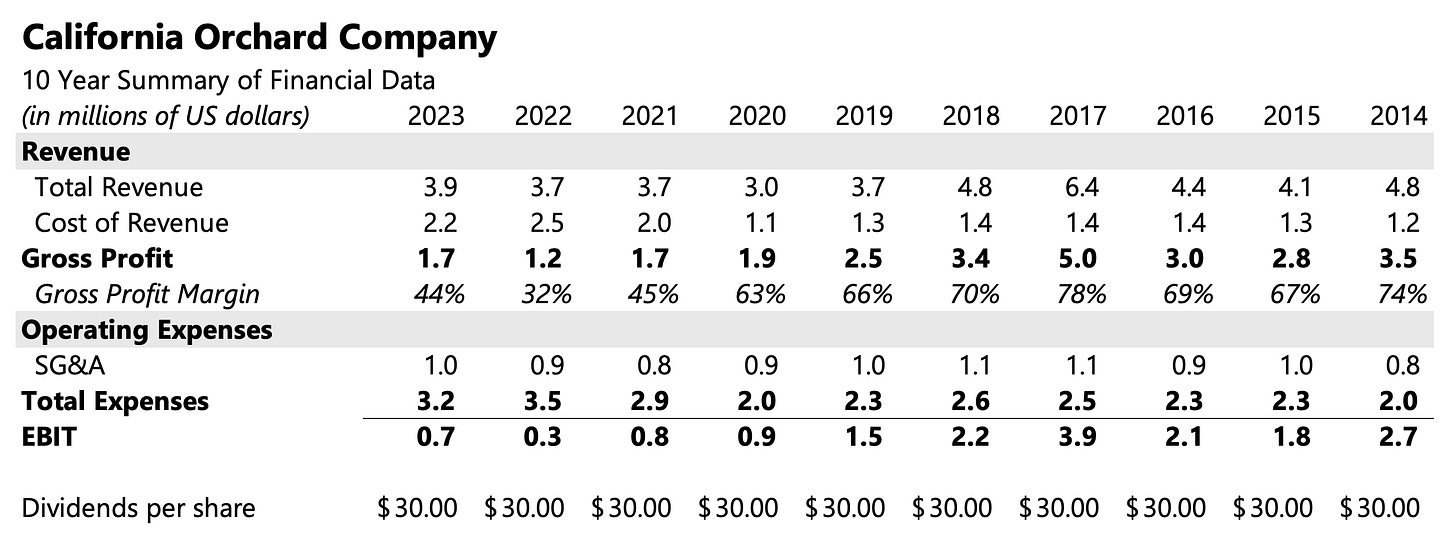

On average, gross profits from the vineyard leasing business range from $1.5 million to $2 million (this includes other income from a Verizon cell tower and rental housing provided to vineyard staff).

Approximately 800 acres of California Orchard’s land were previously leased to Scheid Vineyards (OTC: SVIN) a family-controlled winery teetering on bankruptcy. To clean up its balance sheet, Scheid sold some land and assigned its vineyard leases to the buyer in early-2021.

The lease assignee? TIAA, the Aa1-rated, $1 trillion dollar asset management firm (via Nuveen’s farmland platform).

All three lease entities in California Orchard’s annual report are listed subsidiaries of TIAA:

So, overnight, California Orchard’s greatest source of credit risk shifted from an insolvent, unprofitable winery to one of the largest asset managers in the U.S.? Pretty cool!

I've come across just one write-up on California Orchard from 2018 and only a handful of tweets since—none mentioning the TIAA/Nuveen lease assumption in 2021.

I may be missing something, but it seems like only insiders and a select few quiet shareholders are aware of (or interested in) this step change. Perhaps its impact has been dulled by the recent performance of the grape sales segment and the sad state of the wine industry.

Grape Sales

Unlike vineyard leasing, grape growing is unpredictable, capital-intensive, and labor-intensive. It requires Mother Nature’s cooperation and is subject to volatile commodity prices.

California Orchard has sales contracts with some of America’s largest wineries, including Constellation Brands and Jackson Family Wines. In a good year, grape sales from its Airport/Monroe and Centennial Ranch vineyards might generate gross profits of $500,000 to $1 million. However, recent results have been lousy, resulting in losses of several hundred thousand dollars.

What’s it all worth?

As a standalone entity, I think California Orchard is sort of cheap. It should be another bumpy year for wine, but if you’re able to look out a few years and assume a modest grape sales recovery, I think you’re paying about ten times pre-tax earnings. If California Orchard were to be acquired, it would be worth a lot more.

I haven’t been able to pin down exactly how much land it owns. This Monterey County GIS dataset bunches its land together with Salinas Land Company. I think California Orchard owns 1,958 acres, with TIAA leasing about 1,662 of them.

Fully-developed vineyards in Monterey County have recently sold for >$25,000/acre, suggesting a potential value of >$47.5 million for California Orchard’s ~1,900 vineyard acres if it were to be acquired, significantly more than its EV of approximately $12.9 million.

The families of Salinas Land / California Orchard are unlikely to sell to someone that is looking to flip its land for a short-term profit, it would need to be a permanent or near-permanent capital vehicle.

While I don’t expect an imminent sale, I’d bet that TIAA/Nuveen is trying to make a deal happen. Investors prepared to endure years of illiquidity, family control, and the inherent challenges of grape farming may find a well-protected downside and a steady 5% dividend yield while they wait for that day to come, if it ever does.

Disclosure: No position, but I plan to buy CAOX shares as they become available.

THIS IS NOT INVESTMENT ADVICE. PLEASE DO YOUR OWN RESEARCH.

Historical Summary Financials

C. C. Teague was the first General Manager of Limoneira Company (NASDAQ:LMNR). He later founded Diamond Walnut and the California Fruit Growers Exchange, now known as Sunkist—the longest standing agricultural co-op in the US. Unfortunately there are no biographies on him.

This is cool. Way to really dig deep

Really interesting