Observations from a de-SPAC liquidation.

~$5 million market cap bankruptcy estate that could be worth approximately $20 million with additional upside potential from a shareholder lawsuit

This writeup covers a speculative bankruptcy situation on the OTC Expert Market. Shares recently traded around a ~$5 million market cap, but I think the estate may be worth approximately $20 million with additional upside potential stemming from a shareholder lawsuit. I am not a bankruptcy attorney or distressed investing expert. Some information contained in this post may be inaccurate.

Please review the disclosure section before proceeding to the full post.

DISCLOSURE: I HAVE A PROFIT PARTICIPATION AGREEMENT WITH AN INVESTMENT FUND THAT OWNS SHARES OF THE PROFILED COMPANY, AND I WILL GET PAID IF THE LIQUIDATION IS A PROFITABLE INVESTMENT FOR THE FUND. THE FUND MAY BUY OR SELL SHARES AS IT DEEMS APPROPRIATE. THIS IS NOT INVESTMENT ADVICE. EXPERT MARKET STOCKS (ESPECIALLY BANKRUPT ONES) CARRY SIGNIFICANT RISK. SHARES OF THE PROFILED COMPANY MAY BE WORTHLESS. PLEASE CONSULT A FINANCIAL ADVISOR AND DO YOUR OWN DUE DILIGENCE

Situation

Electric Last Mile Solutions, Inc. (“ELMSQ”) might be familiar to some by the remarkable speed in which it failed in public markets.

ELMSQ was an electric vehicle company that went public through a de-SPAC with Forum Merger III at the height of the SPAC boom. The deal was valued at $1.4 billion and the company received $379 million in gross proceeds when the business combination closed in late-June of 2021.

It didn’t take long before things began to unravel.

ELMSQ’s board of directors formed an independent committee of the Board in late-2021 “to conduct and direct an investigation, review and analysis of certain sales of equity securities made by and to individuals associated with the Company, the corporate law, disclosure and tax consequences of those transactions, and other issues that arise in connection therewith.”

The special committee disclosed the potential wrongdoings that occurred prior to the business combination in this 8-K.

The CEO and Chairman were forced to resign and sign settlement agreements that, among other things, obligated them to surrender some of their ELMSQ shares.

ELMSQ filed Chapter 7 in Delaware Bankruptcy Court (i.e., liquidation) in June of 2022 – six months after the committee’s investigation results were disclosed.

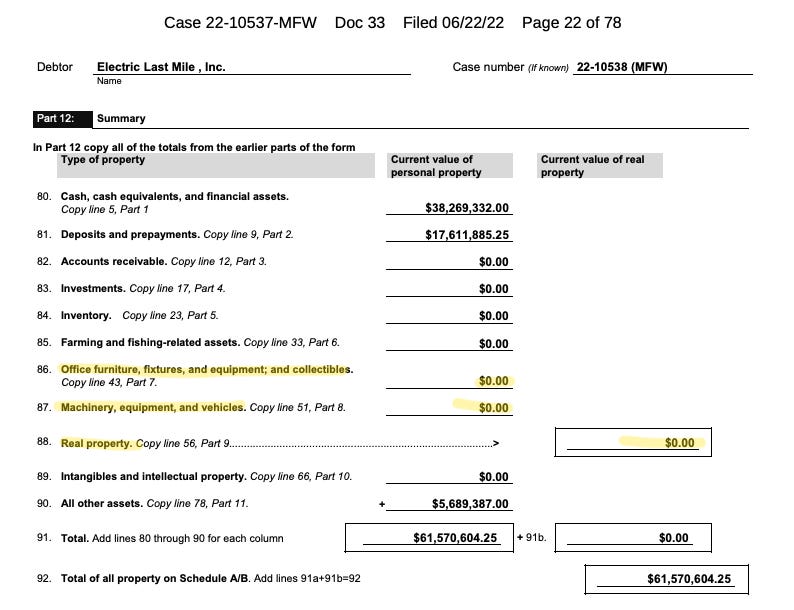

The ELMSQ bankruptcy estate held assets of $61.6 million and faced total secured and unsecured claims amounting to $57.7 million at the time of the petition.

It appeared as though the $3.9 million net asset value would be consumed by legal and administrative expenses of the estate.

A $5 million market cap looked expensive for this SPAC carcass.

Hold on a moment… If the equity was worthless, why did the company choose to file Chapter 7 instead of Chapter 11?

Masked Asset Value

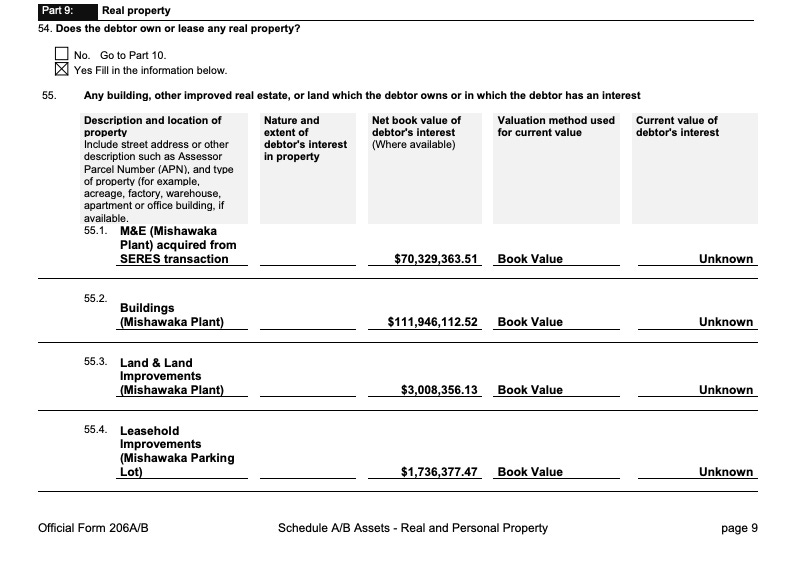

It turns out that ELMSQ owned a 675,000-square-foot facility in Indiana, previously used by General Motors to manufacture H2 Hummers. The value of the Hummer property and equipment was marked as "Unknown" at the time of the bankruptcy petition.

Remarkably, the property and its millions of dollars' worth of manufacturing equipment were assigned a value of ZERO in the initial bankruptcy filing!

I thought my eyes were playing tricks on me.

Here’s more than $200 million of tangible asset value marked at $0 and excluded from the balance sheet summary.

I’m no expert in distressed investing or bankruptcy law, but >$200 million of property and equipment plus the other $61 million of reported assets (mostly cash and deposits) against $57.7 million of liabilities looked like it be worth a heck of lot more than $5 million.

No matter how you marked the value of the Hummer property, the stock appeared to be an exceptionally good bet at a $5 million market cap—despite the unsavory characters involved.

Asset Sale

The trustee of the bankruptcy estate hired an investment banker to broker an asset sale, and in December 2022 the estate sold substantially all ELMSQ assets to Mullen Automotive (another deSPAC) for $104.6 million.

Approximately a 50% haircut to the stated book value of ~$200 million. Not half bad!

Below is a synopsis from a Mullen Automotive shareholder letter:

So here is the basic equity recovery math thus far:

$104.6 million Mullen Automotive purchase price (incl. Mishawaka plant, machinery, and inventory)

(+) $38.3 million of cash held by ELMSQ in the petition (as of 4/30/22)

(-) $57.7 million secured and unsecured claims

(=) $85.2 million net proceeds available to the bankruptcy estate.

To be clear: there is NOT $85 million sitting in the estate’s checking account. The $38 million of cash on hand was dated as of 4/30/2022, approximately 40 days before the bankruptcy filing. Some of that cash was restricted, and the Company would have burned through some of the unencumbered cash, mainly on payroll, severance payments, and other accrued expenses. The estate has also since burned additional cash on attorneys, consultants, and claims.

ELMSQ has no business operations that require ongoing expenses, and it is my understanding that the only estate liabilities that remain are the statutory Delaware trustee commission, administrative costs of the trustee, the remaining unliquidated claims, and wind down expenses.

Based on my review of historical financial statements, pay applications from the bankruptcy docket, the Mullen Asset Purchase Agreement, and other publicly-available filings, I believe the estate will distribute excess cash to shareholders within the next 12 to 24 months. My current expectation is that ELMSQ shareholders will receive total distributions of approximately $0.16 per share, or $20 million from the estate. There is also an ongoing lawsuit against former insiders that may result in an additional windfall for shareholders. Depending on the eventual outcome of this litigation, I estimate that the recovery to the equity may increase an additional $0.12 to $0.20 per share.

The Delaware Court of the Chancery shareholder lawsuit against former ELMSQ insiders involves breach of fiduciary duty claims. Jason Luo and James Taylor acquired shares of ELMSQ’s predecessor entity for approximately $800k. Those shares were worth in excess of $675 million upon consummation of the business combination in June 2021.

I still don’t know if I am missing something major, or if the Chapter 7 bankruptcy filing, limited public float, and illiquidity on the expert market have converged to form the Holy Trinity of mispriced stocks.

The situation is ongoing, and somewhat of a black box. It requires analysts to estimate expenses that have not been disclosed by the bankruptcy estate.

NAV Estimates

NAV is based on the following sources and estimates:

Cash (excluded from purchase price) – ELMSQ had $38.3 million of cash on its balance sheet as of 4/30/22.

(+) Prepayments & Deposits recovery – ELMSQ had $17.6 million of prepayments and deposits per the initial Schedule of Assets and Liabilities, of which I assume $1 million recovery in my base case.

(+) Mullen Auto - Cash Consideration – $55 million of cash from Mullen per Asset Purchase Agreement and Mullen public SEC filings.

(+) Mullen Auto - Land Contract Assumption - $37 million Per Mullen Automotive 8-K and Section 2.1 of Asset Purchase Agreement.

(-) Total Secured and Unsecured Claims - per Ch. 7 Petition filing as of June 2022.

(-) Randy Marion Isuzu, LLC - stipulation agreement per docket filing #253. Max liability shown, net proceeds from liquidation of 257 vehicles will offset the total liability and actual cost may be lower than $7.4 million.

(-) SSG Advisors Fee - per docket #173, 176 and 177.

(-) Miller, Canfield, Paddock and Stone, P.L.C. - per docket #179, 187, and 198.

(-) Giuliano Miller and Company, LLC - per docket #180, 190, and 192

(-) Archer & Greiner, P.C. - per docket #181, 185, and 186

(-) Trustee Commission - Statutory per Section 326 of the Bankruptcy Code (i.e., 3.0% of total secured and unsecured claims)

(-) Other Burn - estimate for expenses of the Company and estate from April 30, 2022 through March 2023. My base case assumes a $35 million burn during this period, which includes estimates for employee severance payments. This estimate may or may not be sufficiently conservative.

(-) Future Burn - estimate for estate expenses from the date of this write-up until the final distribution. My base case assumes $5 million of estate burn during this period, which also may or may not be sufficiently conservative.

Shares outstanding per latest 10-Q as of 11/12/2021. 8.4 million warrants excluded from share count. Share count does not deduct 7.8 million shares surrendered by James Taylor and Jason Luo.

Why does the opportunity exist?

Failed business that held a valuable asset: ELMSQ owned a 675,000 square-foot former Hummer H2 plant in Mishawaka, IN.

Indiscriminate “hate” selling: burned SPAC speculators willing to part with their shares at any price.

Under-followed roadkill: tiny ($7 million market cap), has no research coverage, filed for bankruptcy. Investors abandoned this name, and most have not done any work on the liquidation.

Sourcing shares is cumbersome: requires a full service broker to transact on the Expert Market or calling up former insiders and institutional owners to buy their shares. More effort required compared to pushing a few buttons on Interactive Brokers.

What am I missing?

The ELMSQ situation is not without its share of red flags:

The ELMSQ founders were under SEC investigation.

The Company’s auditor resigned.

ELMSQ was behind on its SEC reporting leading up to the bankruptcy filing, and the company’s financial statements were supposed to be restated.

The bankruptcy petition contains unaudited financial schedules.

The trustee has not posted financial accounts for the estate recently, and there are various unliquidated claims on the register.

Again, I am not a bankruptcy lawyer or distressed investing expert. There are quite a few unknowns here. That said, I’ve read enough source documents to get comfortable with my analysis, and I believe my assumptions to be reasonable.

All unsecured creditors must be paid in full before stockholders see a dime from the estate. ELMSQ shareholders are the last dog at the bowl. So there is the potential for an unliquidated claim with contingent liabilities to wipe out the entire estate.

Caveat emptor!

SPAC - DESPAC, big risks there, not for me. Interesting post though, thank you.

Question to all: which broker is offer you access to Expert Market and would you recommend them?