DallasNews Corporation - DALN

I believe DALN’s risk/reward setup has once again become attractive enough to warrant a brief follow-up. This post is a continuation of an idea I originally pitched last May.

I recommend reading Part I at the end of this page before continuing.

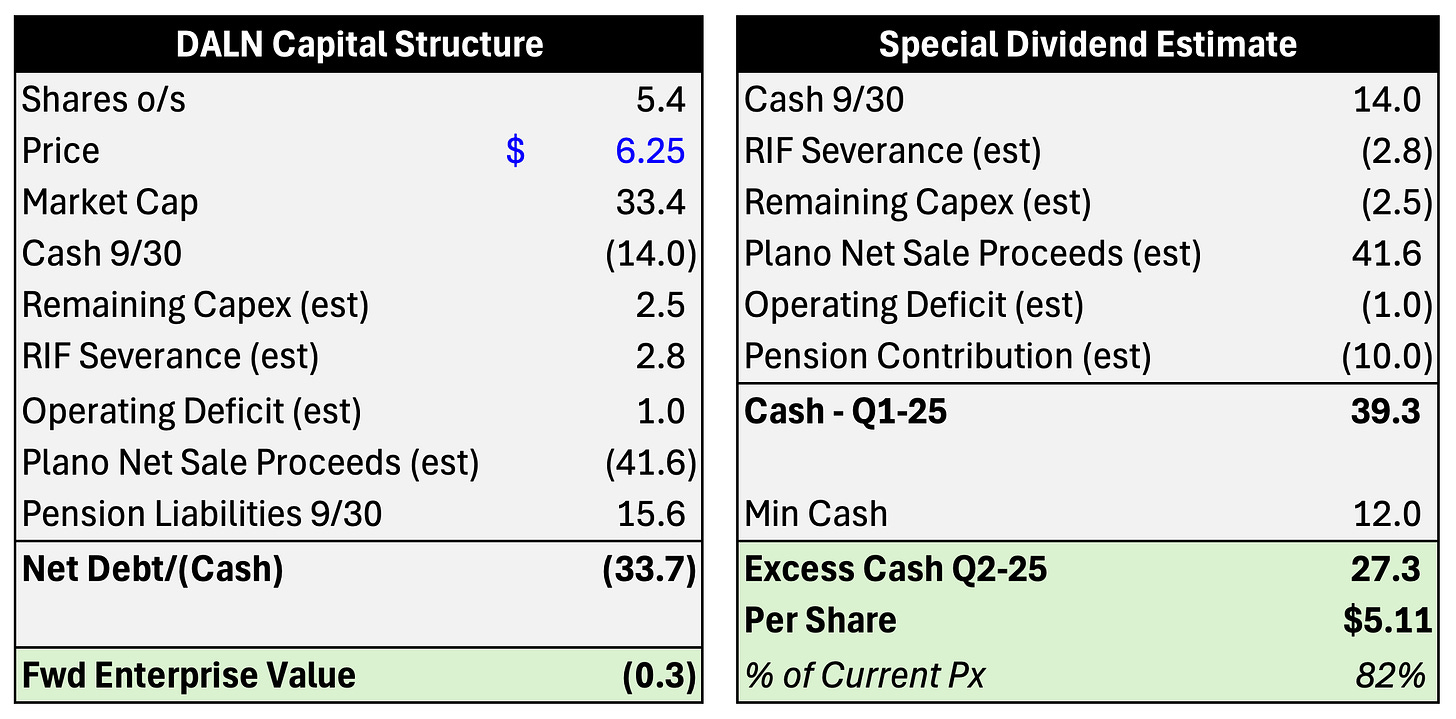

DALN expects to close the sale of its print facility next week, and the newspaper is on the verge of an earnings inflection. The downside is well-protected at $6.25, and I value DALN shares at $10 to $12.

Property Sale

There’s always a risk that a buyer walks away from any deal—but in DALN’s case I view that as unlikely. DallasNews spent about three months vetting potential buyers, and it supposedly picked the best offer with the least execution risk (i.e., a manufacturer that will use the existing building).

The buyer is already occupying a portion of the property for storage, and its earnest money deposit became non-refundable a few weeks ago. If the Buyer decides to walk, it will forfeit $1.3 million.

Based on what I’ve heard, the brokers received about fifty offers on the Plano property. If this buyer were to back out for any reason other than a seller default, DALN would retain the $1.3 million deposit and could re-engage the other groups that previously submitted offers.

Profitability and Return to Growth

DallasNews' circulation revenue seems to have stabilized, and the company will eliminate 85 full-time print positions.

The transition of print operations from Plano to Carrollton is not expected to impact print and distribution revenue because the new press (pictured below) will meet current capacity needs. DALN can renew its third-party print and distribution contracts with the New York Times, Wall Street Journal, etc. and the $5 million of annual cost savings should flow to the bottom line.

I expect DallasNews to earn between $3 and $5 million this year, net of one-time costs outlined below. The business has a large, >$50 million federal NOL balance, so its operating profits should be tax-free for the foreseeable future. I also expect the company to pay a $3 to $5 per share special dividend in the next few months.

New Shareholders

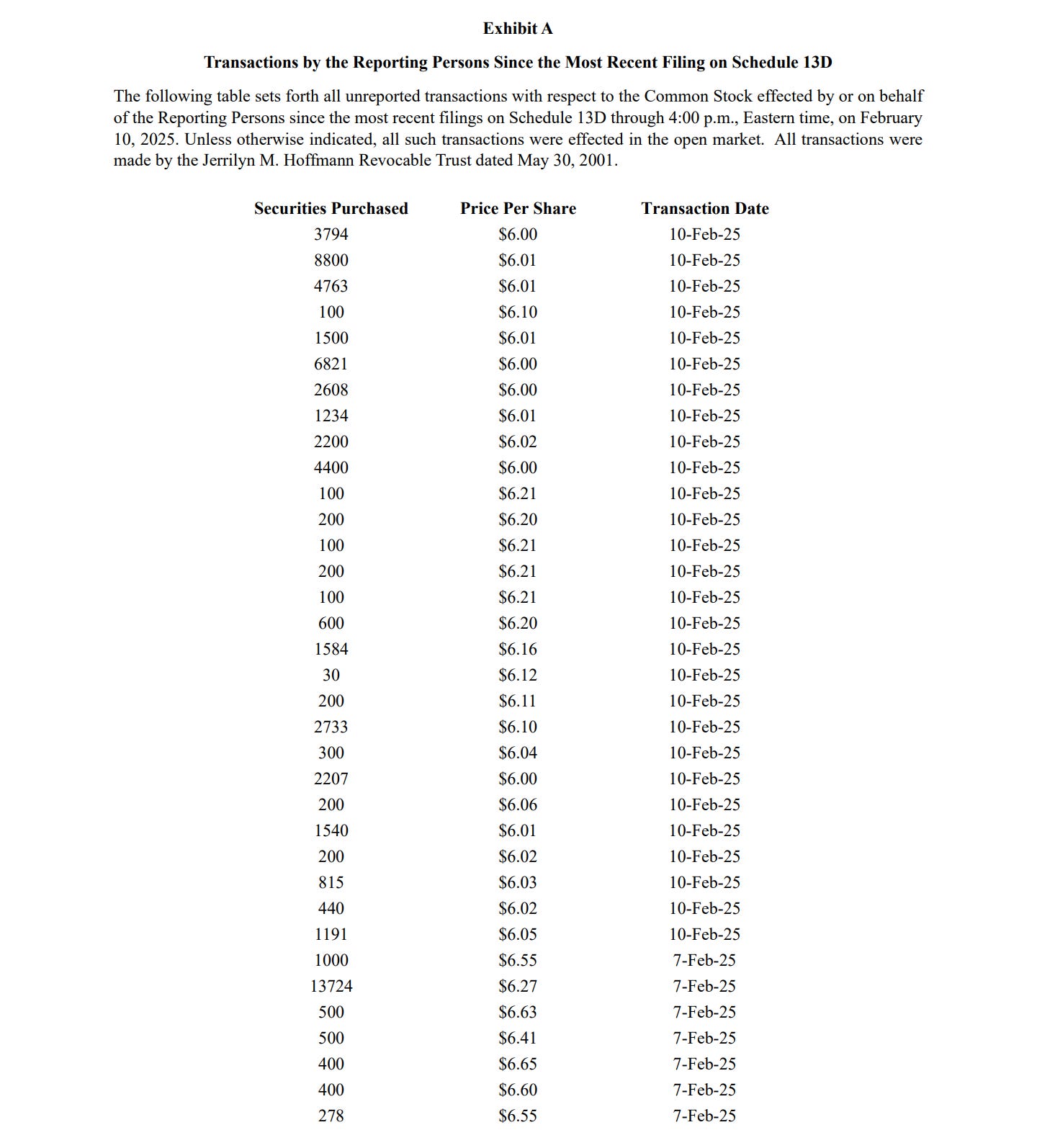

Since my original write up, three new shareholders have appeared on the register. Hoffmann Family of Companies, Covista Capital, and Carlson Ridge Capital have disclosed >5% ownership interests. According to a recent press release, the Hoffmann group has engaged Stifel as strategic advisor for its DALN investment.

Disclosure: I own DALN shares

CORRECTION: An earlier version of this post included a reference to the Hoffmann group’s 13D/A filed on 2/11/2025. The Schedule disclosed a 4.4% stake, lower than the 6% stake it reported on 12/23/2024. The Hoffmann group may have mislabeled DALN share sales as purchases in Exhibit A of the 2/11 filing.

Part I

Special Situation: DallasNews Corporation

May 16, 2024

Price: $3.68

Market Cap: $19.69 million

DALN is off the radar of most investors. The stock trades at $3.68 (~$19.7 million market cap). The Company has $19 million of cash and short term investments, an industrial property that may be worth multiples of its current market cap, and the incremental value from its operating businesses (i.e., Newspaper, Ad Agency, and Printing Company) could be worth an additional $25-100 million. No sell-side analysts cover DALN, and the Company has no bank debt*.

I have followed DALN for the last 4-5 years. Shares have been statistically cheap for some time, but there have not been substantive changes to the bloated cost structure of the shrinking business. Executives are paid handsome salaries and cash bonuses for a business that has burned about $1 million per month for the past few years. Unfortunately, there is no opportunity to go “active” on the Board or Management because majority voting is controlled by DALN’s former CEO and Chairman, Robert Decherd.

What's Changed?

Earlier this week the Company put out a press release announcing plans to: 1) suspend its quarterly dividend, 2) reduce its print staff by 60%, and 3) sell its Plano property. The Company expects to move its print operations to a leased-facility in Carrollton, TX that is approximately 1/10th the size. Unfortunately, the new facility will require an $8 million investment to purchase and install more efficient printing equipment. However, the headcount reduction is expected to save the business $5 million per year, and the sale of the Plano property could net the company $25-40 million, 1-2x the current market cap. This announcement comes just six months after the completion of a voluntary severance program that is expected to save the Company $3 million per year.

*DALN is the Sponsor to two pension plans. No additional benefits are accruing under the DallasNews Pension Plans, as future benefits were frozen.

Business Introduction

DallasNews Corporation, formerly A.H. Belo Corporation, is an incomplete turnaround story. DALN was spun out of Belo Corp in 2008 with a hodgepodge of media assets and real estate, including: a local Dallas-Fort Worth television station, three newspapers (The Providence Journal, The Press-Enterprise, and The Dallas Morning News), properties in Texas, California, and Rhode Island, and minority interests in cars.com and apartments.com. Since the spin-off, nearly all of DALN’s properties and media assets have been sold, except for the Dallas Morning News.

Today, DALN is operationally divided into three business units:

The Dallas Morning News

DFW Printing Company

Medium Giant (creative agency)

DALN has four main revenue buckets: Subscriptions to the Morning News, ads in the Morning News, creative agency services, and printing and shipping on behalf of other newspapers and businesses. The Dallas Morning News was founded in 1885 and is currently the second largest print newspaper in Texas by circulation (Houston Chronicle is #1). The stock has underperformed recently due to declining print circulation and operating losses ($54 million federal NOL balance as of 12/31/23). However, paid digital subscriptions to the Dallas Morning News have demonstrated satisfactory volume and ARPU growth, and the stage is set for a cost restructuring to complete a turnaround of the business.

Main Thesis Points

Discount to hard assets supports downside

Digital growth obscured by decline of print circulation

Restructuring

Large discount to private market value

1) Discount to Hard Assets

The key margin of safety to this idea is property. DALN owns a 630,000 square foot print facility in Plano, TX that is situated on 1.2 million square feet of land (approx. 29 acres) and the County assesses it at approximately $17 million.

Based on recent sales in Dallas and this submarket, I believe industrial buyers would value the property somewhere between $25 and $40 million in a sale. In addition to reviewing comparable submarket transactions, I have talked to a few DFW industrial brokers, appraisers, and operators, and they have confirmed that typical Plano industrial assets trade in my valuation range.

I commissioned a Broker Opinion of Value from CBRE's Dallas industrial team in early 2023. CBRE provided two marks: $31 million if it were sold vacant, and $41.4 million if DALN executed a sale leaseback. While I don’t hold myself to be a Plano industrial expert, I think my 25-40 million range is reasonable.

DALN’s CEO commented this morning on the possibility of the site being sold to a data center or e-commerce user. Perhaps Amazon or Google would be willing to pay a fancy price for the asset:

Grant Moise, Chief Executive Officer - Q1-24 Earnings (emphasis added)

“This decision also allows us to patiently weigh our options with the 29-acre property in Plano, which is zoned as a light industrial property. Light industrial zoning provides a variety of options with the North Plant, including the potential use as a data center or other types of logistics operations that are popular in our e-commerce-driven society.”

The Plano print facility is the only property DALN owns. DALN has sold a half dozen properties since 2015, including its former headquarters. I believe there is a high likelihood that the Plano property is sold in the next six to twelve months, and a portion of the net proceeds will be distributed to shareholders. As a recent example, the Company paid a $1.50/sh special dividend (~$8.0 million) and made a voluntary pension contribution of $5 million after the sale of its headquarters in 2022.

2) Digital growth obscured by decline of print circulation

As of March 31, the Morning News had 129,857 total paid subscribers: 62,434 digital and 67,423 print. According to my research, Morning News print circulation peaked at around 500k subscribers in 2005, and has been in a nosedive ever since.

Print newspapers are capital intensive, low-margin businesses that rely on multiple commodities and volatile expense inputs (e.g. machinery repairs and maintenance, newsprint, ink, fuel, utilities, property taxes, et al). In contrast, digital subscriptions are capital-light, high margin businesses. Digital news subscriptions have near 100% incremental margins. As subscriptions grow, the service can sell more digital ads at high incremental margins.

Like many other regional newspapers, the Dallas Morning News gave its digital product away for free for nearly twenty years, and it was slow to monetize its online presence. Yet, DALN’s digital circulation revenue has grown tenfold since it began reporting subscriptions in 2016. Digital subscriptions to the Morning News are currently on a $18mm run rate, assuming no changes to pricing or volume. DallasNews.com attracts about 8 million monthly visitors, so, the paid conversion opportunity is massive. There are some smaller independent news publications in Dallas (e.g., Dallas Observer, Dallas Express, etc.) but the Morning News is by far the leader in terms of circulation and relevance. So, there are some real tailwinds for circulation and ad revenue being The Paper in Dallas, a fast-growing megacity.

3) Restructuring

There is no telling when the Morning News print circulation will bottom, but the stock is priced as though it will go to zero tomorrow. By my math, the company is now run-rating approximately $400-500k of cash burn per quarter. If management is able to permanently pull $8 million of costs out of the business without sacrificing too much print and distribution revenue you can proforma your way into a well-capitalized and profitable business (see operating results of the Wisconsin State Journal and Arizona Daily Star from Lee Enterprises 10-K as profitable regional newspaper comps).

4) Trades at significant discount to private market value

What gives me additional comfort on the downside protection here is the sheer value discrepancy. The New York Times acquired The Athletic for $550 million in cash or ~$458 per subscriber in 2022. News Corp bought Investor’s Business Daily for $275 million or ~$2,570 per subscriber in 2021. If you take the average of those two transactions and cut it in half, you get $757 per subscriber. Applying $757 to DALN’s current digital subscribers gets you to a $47 million value, more than 2x the current market cap…ascribing zero value to the hard assets.

In the event DALN becomes "in-play" I believe there would be a number of strategics interested in the name that may be willing to pay more than $757 per subscriber. DALN’s subsidiary, DFW Printing, is a regional print site for the New York Times [NYT] and the Wall Street Journal [NEWS]. Lee Enterprises [LEE] has no presence in the Dallas-Fort Worth market. Alden Global has attempted to buy Gannett and Lee Enterprises. Lastly, there is no shortage of wealthy Texans that would enjoy seeing their names in the news. Michael Dell, Mark Cuban, David Bonderman… name your Texan billionaire. I imagine one or more of these folks would lob in a bid for the Morning News if it's marketed for sale.

Valuation

For the sake of simplicity, below is how I think about valuing the business if were sold in a change of control transaction today. Note, this cocktail napkin SOTP ascribes zero value to the $15 million revenue printing and distribution business and zero value for $85 million revenue print newspaper.

Conclusion

DALN combines a margin of safety, lots of option value, several catalysts, and an attractive valuation on both an absolute and relative basis. DALN has multiple positives going for it: 1) a discount to liquidation value, 2) a viable and attractive digital business with a long growth runway, 3) a material cost restructuring underway, 4) a potentially large capital return event, and 5) potential for a strategic buyer to pay a premium for the business. The biggest negative seems to be the fact that the company is currently losing about $400-500k million per quarter, potentially more. The execution and timing of DALN’s restructuring is difficult to predict, but it is not difficult to see an asymmetric setup at the current valuation.

I agree with the DALN thesis but will point out that I think the Hoffman entity actually recently sold ~80,000 shares as the 13D fell from 6% to 4% ownership. I believe that worksheet incorrectly says "Securities purchased" but should say sold. They don't seem to know what they are doing, perhaps they were rebuffed by management as they bought the stake without ever talking to them in the first place. They have also gotten their teeth kicked in buying LEE.

Hi Tiehack,

Appreciate your analysis and insights on this one. Bit of a downtick recently with Q4 results not being great and the management team not fully committing on timeline for the special dividend. Where do you see this heading, are you still holding? I feel like people have overreacted for a few reasons:

1) Special Divy:

Back in 2022, on 27 July earnings call they were asked when they were going to pay the special divy for the note receivable. The response was pretty much the same non commital as this time round:

" The Board will continue its regular discussion of capital allocation, including the possibility of a special dividend and a voluntary pension contribution at its regular meeting in September. And we're saying it's a September meeting because that's the next scheduled time, but there's nothing to say we wouldn't, wouldn't take action sooner."

Less than one month, on 22 August they announced the special dividend to be paid and put up for approval in September Board meeting.

Feels like we will see the same here, within one month we will know what the special dividend is and I'm expect $3.50 per share.

2) Shareholder register

Agree that it is ridiculous that Management have no skin in the game and are taking home golden salaries for the size of the company. Also unfortunate the Class B Shares and Decherd's voting rights accounting for >50%. Is there no other way for the likes of some of the institutionals such as Covista, AllSpring, Carlson Ridge, Hoffman etc to exert some pressure? Just across those there's still ~30%+ shareholding.

3) Q4 Results

Even annualising the soft December quarter and overlaying the $5m savings, the business is basically at breakeven (~-$0.4m). Hardly a disaster?