Nankai Plywood - TYO:7887

Profitable net-net: 80-year old building materials business trades at 0.2x tangible book value, 50% insider ownership.

Nankai Plywood (NP) is the cheapest stock I own, and one of several microcap companies in my Japanese net-net basket. Plus, its ticker symbol is a palindrome. What’s not to like?

NP was founded in 1942, and is based in Takamatsu. It’s a third generation family-owned wood paneling manufacturer. Its flooring and ceiling products are primarily sold to construction companies and homebuilders.

The business is typically profitable, it has earned an operating profit in 19 of the past 23 years. Recently it has averaged pre-tax earnings of about $10 million US, but investments in overseas subsidiaries have sucked up most of the business’ operating cash flow.

It’s almost a double net-net. NP’s market cap is $35 million US (¥5,430 * 0.97 million shares) compared with NCAV of about $60 million US. Book value is just over $155 million US, and is supported by significant tangible assets.

Nankai owns properties in Japan, France (oui), and Indonesia—including three large industrial facilities in Kagawa (pictured below). It uses some debt to fund working capital and construction projects, but not too much to cause me concern.

Beyond its core operations, Nankai holds $13 million US in investment properties and $6 million US in cross-shareholdings, excess capital that could potentially be returned to shareholders without affecting business operations.

Why is it so cheap?

Nankai acquired ROLPIN, a French plywood manufacturer, out of bankruptcy in 2014. It expected ROLPIN to produce sales of €37 million and earnings of €2.3 million by 2017.

NP invested in upgrading ROLPIN’s facilities, including France’s largest liquefied natural gas installation, while also providing cash to cover its operating deficit.

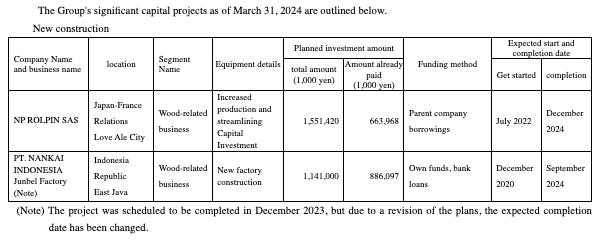

Since the acquisition, Nankai has invested €34 million in ROLPIN, though I don’t believe the subsidiary has turned a profit.

Meanwhile, Nankai has also been funding the construction of a new factory in Indonesia. The Junbel factory was originally expected to be completed by December 2023, but the project has taken longer than anticipated.

NP over-earned for a few years while it benefitted from elevated lumber prices in 2021. I suppose the stock is so incredibly cheap because of the collapse of lumber prices, decline in Japanese housing starts, and the cash drain of French operations.

Looking out a few years, I think NP’s free cash flow conversion should improve as the capital needs of ROLPIN and Junbel taper off. The downside protection is attractive enough for me to justify a basket-sized position, even if the French operations do not improve in the near-term.

I have 1.5% of my assets invested in Nankai Plywood. If ROLPIN were sold, turned around, or wound down I’d likely make it a bigger position.

Disclosure: I own Nankai Plywood shares.

THIS IS NOT INVESTMENT ADVICE PLEASE DO YOUR OWN RESEARCH.

P.S. Japan’s Awakening

Many value investors have written off Japan as a wasteland, but I’m of the view that a dramatic transformation has just begun.

Japanese capital markets are in the early stages of a psychological restructuring, driven by reforms from the Tokyo Stock Exchange.

The TSE reforms are already showing results—management-led buyouts, tender offers, buybacks, special dividends, and increased foreign investment are becoming more commonplace. Nearly every morning, I see a wave of transaction announcements at substantial premiums, and I expect the trend of pro-shareholder corporate actions to continue.

Analysts far more knowledgeable than I have published some insightful research on Japanese stocks and the recent reforms:

Valuing Japan’s Reform and Japan’s Orphans - Verdad Advisers

Japan: Anchoring Bias Writ Large - Bireme Capital