The Logan Clay Products Company - OTC:LGNC

Logan Clay is a consistently profitable, niche industrial business that trades on the OTC expert market. For more than 135 years, Logan Clay has made the world’s longest-lasting pipe for sanitary sewer systems: vitrified clay pipe (“VCP”).

VCP is considered superior to other sewer pipe materials because of its durability and resistance to corrosion. Plastic and metal pipes, on the other hand, are more susceptible to leaks and breaks as they age and typically require more careful maintenance.

Clay pipe has been used in sewer systems for more than 3,000 years, and some ceramic sewer pipes around the U.S. have reportedly been in continual service for more than 200 years.

Municipalities tend to prioritize long-term performance and reliability over upfront cost, much like choosing brick for schools and other public buildings. In fact, some municipal building codes require clay pipe in sanitary sewer systems due to its proven durability and service life.

It should be no surprise that Logan Clay’s core business is supplying main sewer lines (aka “trunk lines”) to municipalities and utility service providers. As a recent example, Logan Clay sewer pipe is being installed as a part of the $8 billion Chicago O’Hare airport expansion.

History

As far as I can tell, Logan Clay ran into some financial trouble in the late 1940s.

Its controlling shareholders, E.K. Sheffield and Carrie Pfeiffer, decided to put the company up for sale.

In 1950, employee Barton Holl, with backing from a former U.S. senator, acquired a controlling stake. Today, Holl’s grandson Dick Brandt and great-grandson Rudy Brandt continue to own and operate the business.

Logan Clay shares last traded at $222, or a $15.8 million market cap.

As of its most recent annual report, LGNC held net cash of $8.9 million, leaving an enterprise value of only ~$6.9 million.

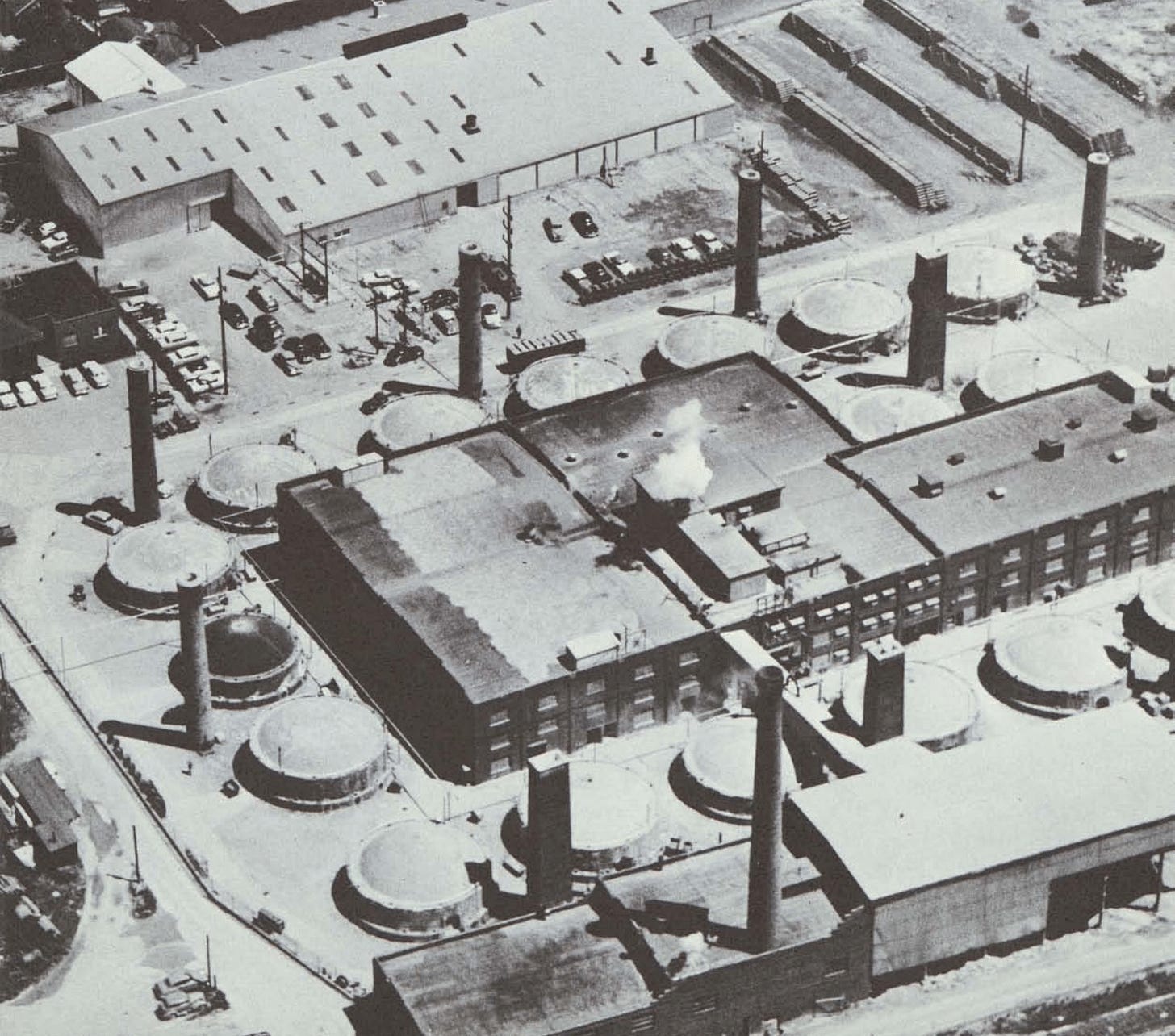

In addition to the cash on the balance sheet, LGNC owns several properties: its clay manufacturing plant (22-acre site in Logan, OH with two large manufacturing buildings) and production facilities (25-acre site in Haydenville, OH).

Logan Clay acquired Silvesco for $1.9 million in August 2023. Silvesco is a pallet manufacturer based in Marietta, OH. As part of the acquisition, Logan purchased Silvesco’s 4.8-acre production facility in Marietta.

I don’t have a good sense for the market value of Logan Clay’s equipment (kilns, trucks, presses, etc.) but I do think the business is trading below the liquidation value of its tangible assets and well below replacement cost.

LGNC EBITDA in 2024 and 2023 was $4.6 million and $3.6 million, respectively.

Maintenance capex and depreciation recently have been in sync: about $1.0 million to $1.5 million per year. So, we’re looking at a very undemanding valuation: 1.5-2.0x EV/EBITDA for a consistently profitable, niche business with a long runway.

Sewer pipes break constantly, and barring any significant innovation in pipe materials science, Logan Clay can reasonably expect another 135 years of consistent sewer main replacement demand. And assuming LGNC can continue to keep its eye on costs, the business should be able to remain consistently profitable for the years to come.

Logan Clay is a business I would love to own a piece of at the current valuation, but shares rarely trade hands on the expert market. While I’m not expecting the business to be sold anytime soon, I cannot imagine a scenario where a financial or strategic buyer would pay much less than double the current share price to acquire the business.

P.S. I’d like to thank one of my readers for providing a copy of the Company’s 2024 annual report, without which I wouldn’t have been able to complete this write-up.

An incredibly consistent business. Thanks for the writeup.

Can you please dm me the annual report?