American Biltrite - OTC:ABLT

Today’s stock is another one of those unusual and tiny companies that almost no one follows: American Biltrite.

American Biltrite (ABLT) is a global manufacturer and supplier of industrial tapes, protective films, commercial flooring products, and costume jewelry and hair accessories.

The business is majority-owned and operated by the third and fourth generations of the Marcus family. It was founded in 1908, and initially focused on producing shoe heels and soles.

ABLT shares last traded at $73.5, valuing the equity at about $2.3 million.

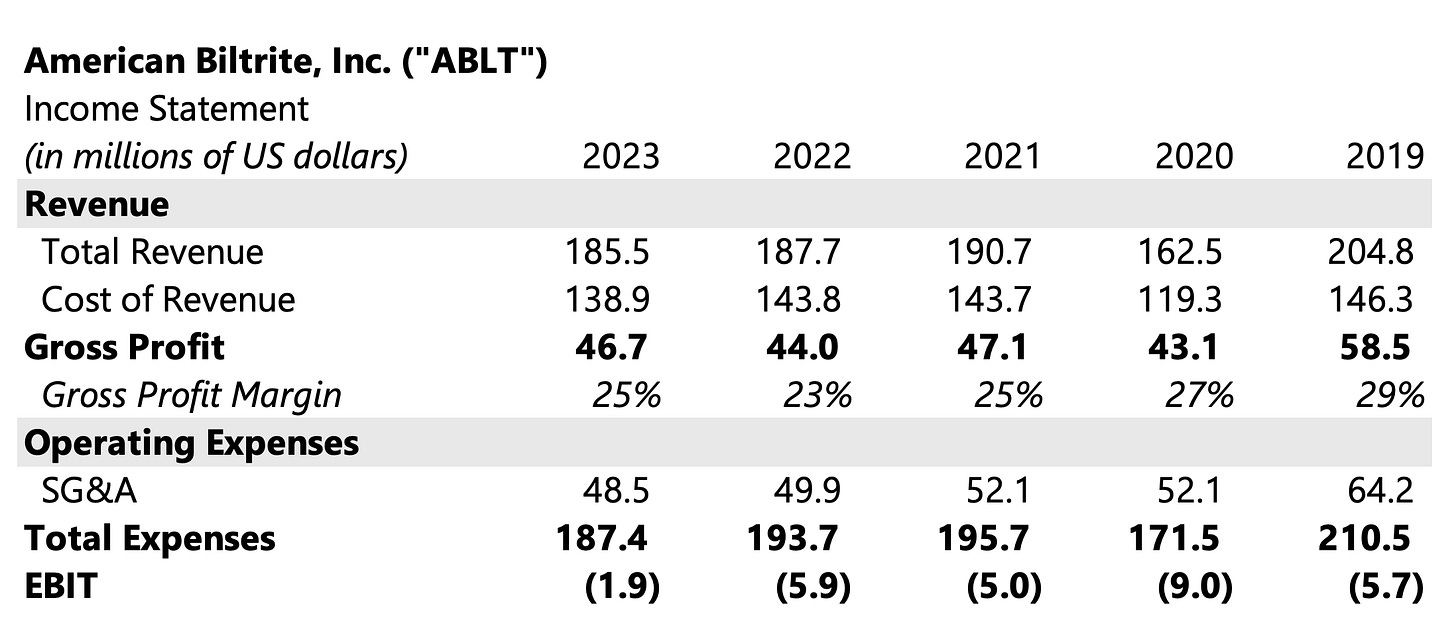

Biltrite is a real business, but it has capital structure and cost structure problems that cause it to routinely lose money. I suspect that insurance and legal expenses are the culprits because the company is plagued with legacy asbestos liabilities.

Asbestos

In 1961, American Biltrite acquired Bonafide Mills, a company that made vinyl and asphalt products with asbestos. It also eventually acquired Congoleum, another manufacturer of flooring products made with asbestos.

From what I’ve read, ABLT ceased production of asbestos-based products around 1985. By 2012, it was a named defendant in 1,338 lawsuits. Yikes.

Asbestos has been a widow-maker for many blue chip stocks (e.g., Pittsburgh Corning, Owens Corning, US Gypsum, Kaiser Aluminum, etc.) Congoleum, ABLT’s former subsidiary, was forced into bankruptcy because of its asbestos exposure.

The early 2000s brought a tidal wave of mesothelioma lawsuits, court rejections of proposed settlements, and insurance cutoffs. Financial stress after the dotcom bubble burst forced many asbestos-exposed companies into bankruptcy.

What makes Biltrite different? The Marcus family refused to file for bankruptcy twenty or so years ago, because they believed its insurance would cover almost all of the settlement costs. ABLT’s equity rode right on through the reorganization when Congoleum filed Chapter 11 in 2003, but ABLT shares have declined >95% since.

Today, the company carries $41 million of asbestos and environmental liabilities as well as insurance receivables of about $10.4 million. It continues to fight mesothelioma claims in courts all over the US, and has recently relied on debt to fund operations.

ABLT was virtually unlevered until a few years ago. As of the most recent quarterly report filed today, it had a total debt balance of $28 million in a facility with Wells Fargo.

I don’t know if Biltrite can survive without a bankruptcy filing.

It owns >$100 million of tangible assets, mostly receivables, inventory, and property. I think it is possible to turnaround the business, but the Marcus family would need to make significant changes to business operations.

A few options it might pursue:

Adopt a new cost structure: If the company is going to earn its way out of distress, now would be the appropriate time to launch a cost-cutting initiative.

ABLT’s longtime CFO, Skip Feist, recently retired after twenty five years with the business. The new CFO, Chris Hurd, brings more than thirty years of FP&A experience. He spent the last five years as CFO of a PE-owned packaging company.

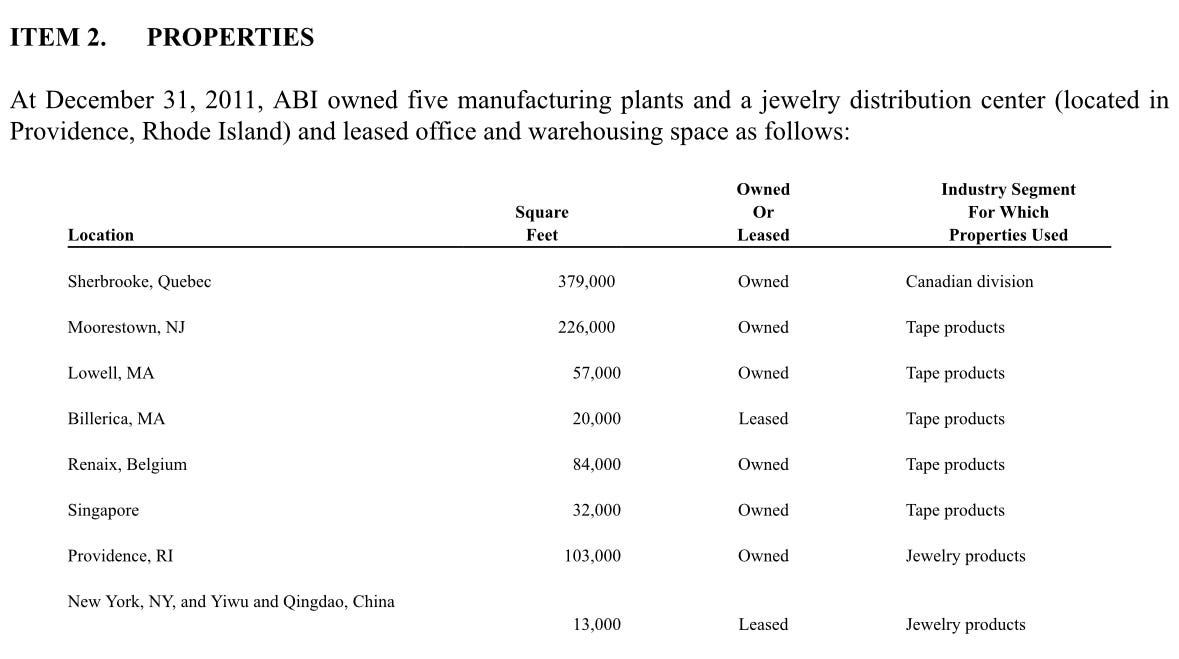

Sell property: ABLT owns a portfolio of six properties, about 881,000 square feet in total, across the northeast US, Canada, Belgium, and Singapore. I believe most of these properties could be worth >$50 per square foot in a portfolio leaseback our outright asset sale.

ABI’s second largest property is probably its most valuable on a per square foot basis. Moorestown is just outside of Philadelphia, where similar vintage industrial assets trade for >$100 per square foot.

I suppose it’s unlikely that the Moorestown facility is sold soon. The Massachusetts-based Ideal Tape team is apparently being folded into the Moorestown facility.

It’s probably more likely that ABLT sells its Lowell, MA property (assessed at a $3.2 million) in the near term.

Divest a subsidiary: Selling a non-core division, such as K&M (costume jewlery) could provide an immediate cash infusion.

Negotiate with creditors (claimants and Wells Fargo) ABLT may consider renegotiating loan terms with Wells Fargo, either by extending maturities or obtaining covenant relief while it executes on cost-cutting and/or asset sales. If ABLT can demonstrate progress on these fronts, it may be able to negotiate better terms.

On the asbestos front, ABLT could seek a structured settlement approach, similar to what other companies with asbestos liabilities have done. Establishing a trust to manage future asbestos claims, potentially funded by property sales, non-core business sales, or external financing, could provide clarity to claimants while preventing unpredictable cash drains. The key challenge is whether claimants will accept a structured resolution or continue pursuing litigation one-by-one.

Path Forward

ABLT survived two decades of asbestos litigation, several financial crises, and changing market dynamics, but it must restructure to survive, or it will inevitably succumb to financial stresses.

I do not own any ABLT shares, but it’s been interesting oddball to follow, and I’m rooting for the Marcus family to turn things around.

Equity amounts to 20.6 Mio and operating CF is -1.9 Mio. (for 6 months) as per end of June 2025. "Fair value" equity is a lot higher because of the real estate. Let's add 24 Mio. = about 44 Mio (I calculate a value for the real estate of 55.4 Mio. compared to a book value of 31.4 Mio.) . So price to book is very low (MC about 5% of BV). I don't like the negative cash flow and the high debts / liabilities. On the other hand, net loss of 4.4 Mio. (6 months) is not so high compared to sales (88.7 Mio.), about 5%.

It is a speculative bet on successful restructuring, but that would be gambling. I do feel that the company is worth more than 2.3 Mio., but I can't say how much more. It may be possible to use a liquidation value, e.g. 50% of the book value (excluding hidden reserves on the properties, as other non-current assets may be worthless in a liquidation). This would give us a figure of around 10 Mio. (?)

Another issue is the very low liquidity of this stock.

Otherwise, a great blog!