A.D. Makepeace Company - OTC:MAKE

170-year old family-controlled company trading at one-third of book value

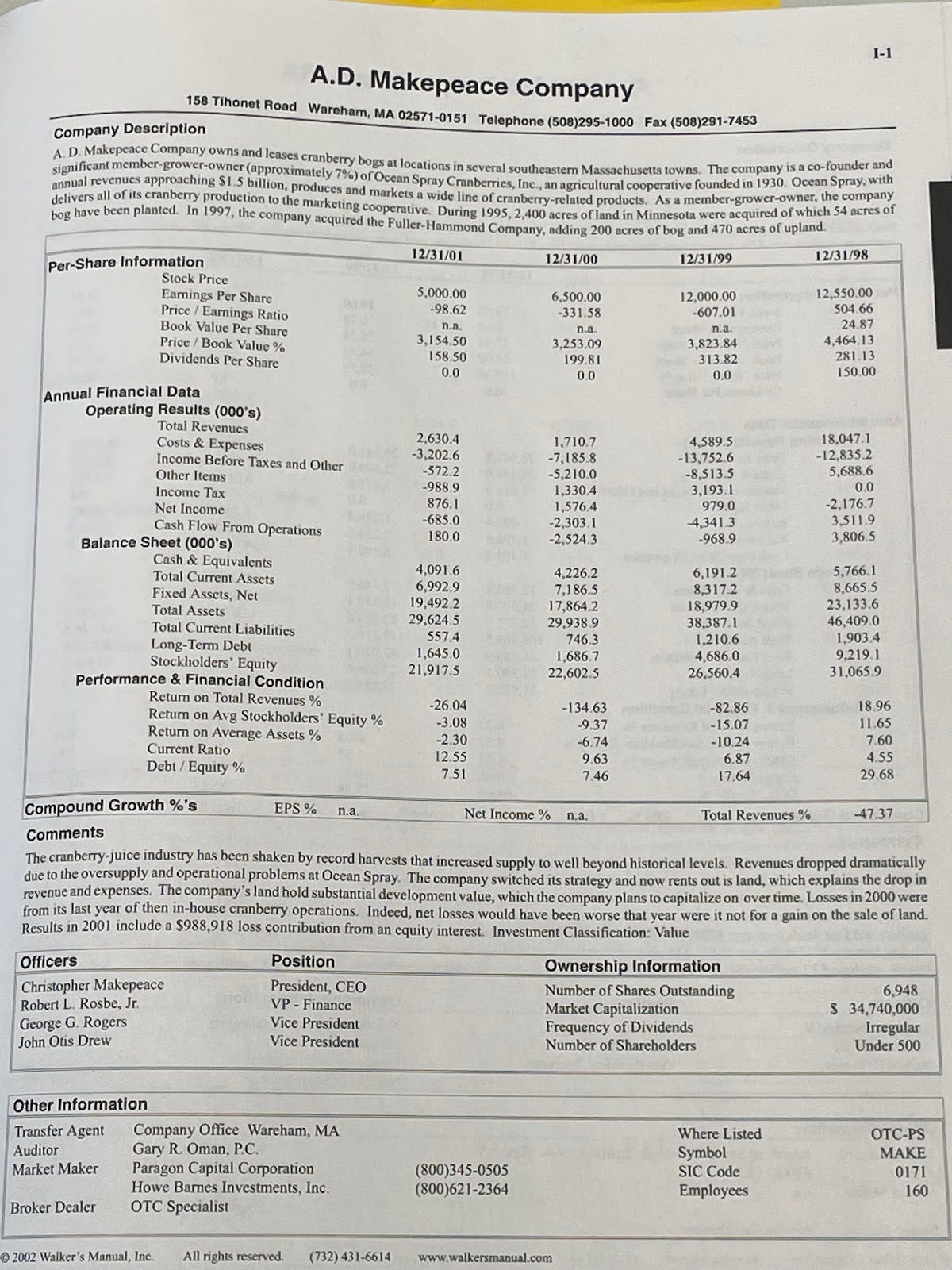

A.D. Makepeace Company is the world's largest cranberry grower and the largest private landowner in Massachusetts. The Wareham-based business was founded in 1854 by 22 year-old Abel D. Makepeace (known as the “Cranberry King”).

The stock trades once in a blue moon on the expert market, most recently at $3,000. Book value per share is $9,163 (as of yearend 2023) and likely understates true net asset value.

The company does not publish financials. Annual reports and quarterly letters are provided only to shareholders.

A friend of mine is a shareholder, and was kind enough to share copies of the company’s 2022 and 2023 annual reports.

Today, Makepeace is divided into three operating businesses: cranberries, real estate, and custom soils and materials.

Cranberries

As the largest grower-owner of the Ocean Spray cooperative, A.D. Makepeace operates about a dozen cranberry bogs in the New England area.

The Ocean Spray cooperative consists of about 700 cranberry farms across the US, Canada, and Chile. Profits from Ocean Spray-branded products are shared amongst farmers based on the amount of crop each farmer contributes to the co-op.

Grower-owners vote to elect a board, and the board oversees strategic decision-making on behalf of the co-op. Farmers benefit from access to a global distribution network and the Ocean Spray marketing engine.

The co-op structure allows farmers to maintain control while competing under a dominant brand. The relationship between the entity and its farmers is quite symbiotic. I can’t imagine trying to compete with Ocean Spray as an independent cranberry farmer.

As a founding member of the co-op, Makepeace owns common and preferred stock in Ocean Spray Cranberries, Inc. (held at cost of ~$11.8 million). The Ocean Spray stock cannot be sold, except to other growers in the cooperative.

Annual sales and segment profits from the cranberry business have been volatile in recent years, so it’s difficult for me to slap a valuation on this commodity-driven business unit with only three years of results in hand.

For those interested in a more detailed account of the co-op’s history, I recommend reading this 2006 academic paper: The Cranberry Industry and Ocean Spray Cooperative: Lessons in Cooperative Governance.

Here is a short excerpt:

Ocean Spray Cooperative was created in 1930 as Cranberry Canners, Incorporated (CCI). Three large cranberry growers—Marcus Urann and A.D. Makepeace, Inc., from Massachusetts and Barbara Lee from New Jersey—constituted the original membership. Initially, the exclusive purpose of the cooperative was to process cranberries that were either unsuitable for marketing as fresh fruit or that represented a price-depressing surplus to the fresh market. Processed products were sold under the Ocean Spray label, which Urann had previously used for his canning company.

The creation of CCI followed several years of destructive competition and price-cutting among independent cranberry processors, with the effects spilling over into the fresh fruit market. CCI was the brainchild of Urann, a strong believer in cooperation, who served as the CEO and board president of the cooperative for 24 years. During the early years of CCI, annual reports often dealt more with the need for cooperation than with the status of the cooperative. Common to this era, the cooperative was perceived as a social/political institution at least as much as an economic entity.

CCI grew to encompass several other cooperatives engaged in marketing fresh fruit as members, thus becoming a quasi-federation. By 1942, four such cooperatives accounted for 75 percent of CCI’s deliveries. Member cooperatives continued to market their fresh fruit under their respective labels and used CCI as an outlet for processing.

In the early years of the cooperative, strong emphasis was placed on expanding consumer demand for cranberry sauce and, later, cranberry cocktail, by keeping store prices low. In 1950, the cooperative boasted that sales had reached the level of one can of cranberry sauce per U.S. household and set a new goal of one can per person.

Real Estate and Other Interests

A.D. Makepeace also engages in real estate development. I imagine the company held a bunch of excess land that it had purchased over its >170 year history, and one day, management woke up and decided to make something of it.

Makepeace is the owner/developer of Rosebrook Business Park (multi-tenant office), 35 Rosebrook (65 apartment units) in Wareham, and Redbrook (1,200 single-family homes / 60k SF of commercial space) in Plymouth, MA. These assets carry an estimated market value of about $75 million.

The Redbrook community is a joint-venture with local builders E.J. Pontiff and Whitman Homes. Makepeace also owns Agawam Spring Water Company, which is a regulated utility company and the sole provider of water to the residents of Redbrook.

Custom Soils and Materials

Makepeace acquired Read Custom Soils, the Canton, MA-based producer of specialty soils, in 2011. RCS helps design, renovate, and maintain golf courses and other sports fields, and more than 400 golf courses throughout New England are serviced by RCS.

The company operates soil blending facilities in Carver and Westford, MA, and a quarry in New Hampshire. You can check out some drone shots of the Carver facility here.

RCS revenues grew >50% between 2021 and 2023, and there are no signs of it slowing. As a standalone business, I think RCS would fetch a premium valuation.

It’s profitable, fast-growing, has lots of recurring revenue, and most customers (muni golf courses) are sticky. Plus it’s economically-advantaged: the geographic limitations of transporting heavy products (i.e., sand, soil, etc.) tend to give rise to pricing power.

Governance

The ownership structure and corporate governance of the A.D. Makepeace Company is a bit convoluted. It’s unclear to me if the business is run in favor of A.D. Makepeace’s descendants, common stockholders, or the Commonwealth of Massachusetts.

According to the annual reports, Makepeace employees participate in a profit-share, where they (full-time employees excluding the CEO & president) share in a pool of up to 12% of consolidated EBITDA.

Members of the Makepeace Board were each granted one share of common stock and one ADM Holdings LLC Member Unit back in 2009, and the company maintains a ROFR to repurchase the stock and units. ADM Holdings is a VIE, and is listed as a noncontrolling interest on the balance sheet.

I haven’t spent enough time looking at the company’s org chart. I don’t think the company has disclosed who owns the remaining interest in ADM Holdings, or how earnings from the operating businesses, joint ventures, and properties flow to common stockholders.

Summary

Due to the cyclicality of the cranberry farming and real estate businesses, Makepeace’s consolidated earnings have been lumpy. The lumpiness is well-complemented by the growing earnings stream of the custom soils business (+/-$8 million gross profits), steady income from real estate rents (office and residential), and opportunistic sales of properties.

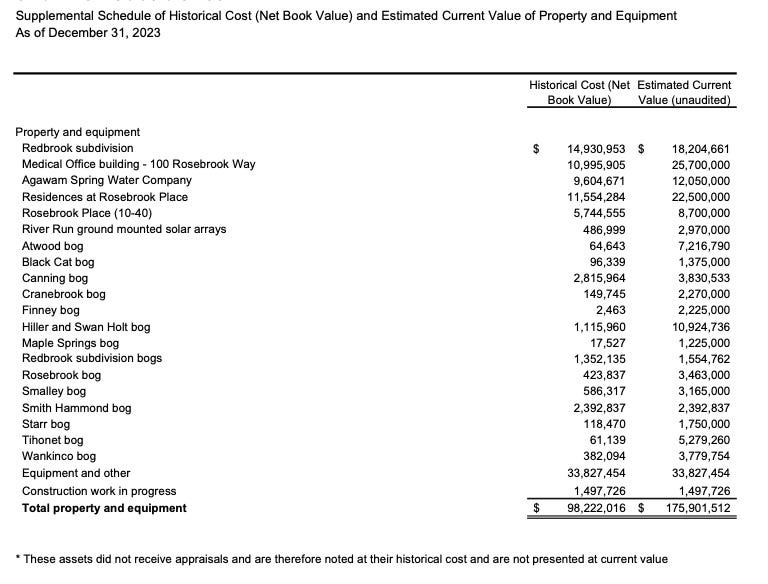

Makepeace sports a balance sheet that deep value investors dream about: property and equipment carried at $98.2 million (compared with fair value marks of $176 million), $38 million of current assets (mostly cash and AR), and the hard to come by stake in Ocean Spray.

No matter how you look at it, MAKE shares are dirt cheap at 30% of book value. If the business were to be sold, I suppose it could fetch >$9,000 per share.

I’d love to coffee-can some shares, but I haven’t been able to buy any.

Note: I could not find any investment writeups on A.D. Makepeace Company. If you own or have researched the company, please don’t hesitate to reach out.

References:

https://usda.library.cornell.edu/concern/publications/zs25x846c

https://www.umass.edu/resec/sites/default/files/19cranberryjan06_0.pdf

https://nerej.com/a-d-makepeace-company-developing-traditional-new-england-neighborhood

https://www.masslive.com/business-news/2018/10/made_in_mass_take_an_inside_look_at_the.html

What a fascinating find - well done. It's a shame the last time a share traded was July 2023!

Good luck buying shares. It rarely trades and I mean rarely.